3GI Ventures 2022 Annual Letter

Dear 3GI Token Holders,

3GI Ventures kicked off its journey earlier this year in March and has since grown to 42 token holders. The past nine months have been incredibly eventful for crypto, and 3GI has been in the front seat navigating a multitude of challenges and opportunities, which helped us become stronger and more resilient as a result. Through hard work and collaboration, we have been able to achieve a great deal and laid the foundation for the exciting opportunity that lies ahead. We are grateful for the support and guidance of our token holders, and we are excited to see what the future holds.

This report begins by providing an overview of the macroeconomic factors that drove global financial markets in 2022, followed by a closer look into the crypto industry’s major developments and market performance; the last section of the report covers 3GI’s investment strategy, portfolio performance, and 2023 crypto market outlook.

2022 Markets Overview

It has certainly been a turbulent year for global financial markets, and the crypto market has been no exception. One persistent theme that drove markets for most part of the year was the inflation narrative and the subsequent rate hikes by central banks around the world. There are numerous factors contributing towards the extremely high levels of inflation seen this year such as soaring food and energy costs amid the war between Russia and Ukraine, the disruption of global supply chains and access to cheap materials because of China’s zero-COVID policy and prolonged periods of near zero interest rates and Quantitative Easing (injecting liquidity in the markets through the purchase of Government Bonds) by leading central banks to boost economic output.

High inflation hurts the economy as it erodes the purchasing power of consumers which has a negative impact on business. Central Banks use interest rates as their main controlling lever to influence inflation. When inflation is high, central banks strive to slow down the economy by increasing interest rates, which end up reducing the rate of inflation. Higher interest rates reduce investors' risk appetite as returns on safe investments such as bonds become more attractive, causing investors to shift their money out of risky assets and into safer investments.

This is why equities and other high risk assets such as crypto experienced a substantial decline in value this year as illustrated in the chart below with the S&P 500 declining nearly 20%, NASDAQ by 30%, Bitcoin by 64.74% and Ethereum by 67.28%.

Zooming into the crypto asset class, the global market capitalization of all crypto assets started the year at $2.25 Trillion after declining from its peak of $2.9 Trillion at the end of November 2021. The market cap has been on a steady decline throughout the year, stabilizing at times around or just under the $1 Trillion mark.

The steepest decline was in April when Terra, the blockchain behind the Luna token, collapsed swiping away over $40 billion and took down with it numerous crypto related companies and some of the biggest hedge funds in the crypto space such as 3AC, Celsius and Voyager. However, the contagion didn’t end there as one particular hedge fund, Alameda Research, managed to extend its runway by a few months given its ties to one of the leading centralized exchanges FTX; however, that did not work out well and both companies went down as a result. The FTX saga which took place in the beginning of November, added fear and further contagion to the space and the global crypto market cap has been hovering just above the $800 Billion level since, touching a low of approximately $750 Billion, a drawdown of over $1.5 Trillion or 66% year to date. We covered the FTX saga in more depth in our November Newsletter if you are interested to go into more details.

In light of this event, it is worth noting that 3GI Ventures has taken protective risk management measures since the initiation of 3GI. Those measures include storing our assets in smart-contract based wallets (Multi Signature) to protect the funds from unsafe centralized exchanges such as FTX and the likes. To understand more about our risk management approach, you can revisit our whitepaper.

Crypto venture funding has remained relatively strong this year despite difficult macro conditions with crypto related projects leading deal-making and funding activity in emerging technologies for the venture capital space this year. Though funding has slowed as the year progressed, the trailing twelve-month total funding was more than double that of Fintech, the next closest sector. However, the total amount VCs invested in 2021 was $33 Billion versus the $21.62 Billion in 2022, a YoY decline of 34.4%.

Regulations

There has been a long debate about whether cryptocurrencies should be regulated as a security under the Securities and Exchange Commission (SEC) or as a commodity under the Commodities and Futures Trading Commission (CFTC). Whether a particular cryptocurrency should be regulated by the SEC or CFTC depends on how it is classified and used. A security is an investment token that represents ownership in a common enterprise led by an accountable team with the expectation of returning a profit. Some cryptocurrencies may fall under the jurisdiction of both agencies, depending on their specific characteristics and the nature of the transactions involving them.

For example, Ripple has been under the scrutiny of the SEC for over two years, after being accused of selling XRP which they considered as a security. Recent updates have pointed out that the fight against SEC has been going exceedingly well, and the matter should be closed by early 2023. Not only is this a big win for Ripple and its growth potential, but also can have a lasting impact on crypto.

There have been dozens of bills floating around Congress addressing different aspects of crypto and blockchain. Although it is still not clear how soon any of them could be turned into laws, there is certainly increased pressure to speed up the process in the wake of the blowouts we saw this year.

3GI Ventures

Intro to Investment Strategy

3GI Ventures kicked off its investment journey with an investment strategy based on long term holding of high conviction crypto projects with huge potential to appreciate in value over a time horizon of three years. However, market conditions this year meant that such strategy was not optimal for capitalizing on short-term market fluctuations so we channeled our focus to benefit from volatility by modifying our investment strategy to cater for the market context. The new strategy focuses on a shorter term horizon to take advantage from brief rallies and book profit, while hedging against market drawbacks. It is worth noting that we still hold high conviction in the long term value of this asset class, however we have shortened the average period we hold a token to maximize the potential profits.

We took a step back and decided to narrow down our focus on sectors that tick the following criteria: A sector that we understand very well, has lots of activity, and we have extreme conviction in for the long term. After going through the exercise, we made the conscious decision to focus on the De-Fi (Decentralized Finance) and Blockchain infrastructure sectors. De-Fi has been one of the hottest sectors in the crypto space for years, and we believe it is still in its infancy - the De-Fi sector aims to build a parallel financial system built on transparency, control and efficiency. In fact, the entire blockchain technology kickstarted a decade ago on the premise that the financial system needs to be disrupted; and this is where the De-Fi dream was born.

Blockchain on the other hand represents the building blocks of the crypto space - the blockchain infrastructure is the enabler of this space, providing the stepping stones of all other applications to be built on.

Since we’ve made the changes in October, our ability to spot opportunities in these narrowed sectors has dramatically improved, which somewhat explains our superior performance over market performance in the past couple of months (more on that below).

Within those sectors, we have applied three main investment strategies: Momentum, Swing Trading and Option Strategies.

New Strategy

Momentum

The core of the fund’s strategy remains focused on investing in high conviction projects and protocols that we believe have fundamental value and present substantial opportunities for growth and value appreciation. Every position we take goes through our investment screening process by studying the value proposition, market size, tokenomics, competition, and traction, amongst other criteria. More on our investment approach here in our whitepaper. We call it “Momentum” because we apply an additional filter to our criteria that requires us to consider the short to medium term (3-6 months) token price appreciation potential. These are usually driven by either internal protocol-specific events such as new product releases, new partnerships, leaps in business model or tokenomics, token listings, etc.. or external events such as adoption of new technology and regulations among others. This strategy enables us to identify investment opportunities that could be attractive regardless of market conditions and the overall market direction, and thus generates returns even when the market is going down.

On the risk management aspect, we have developed a new framework to ensure we keep a healthy level of diversification (maximum 10% of fund size in any token), loss minimization (we exit a position if it depreciates by 50%) and profit taking (we take out the profits every time a token appreciates 25% in value). In addition, we conduct multiple data-driven analyses such as backtesting (to fully understand the token’s historical price movements and what that would have resulted using our frameworks) and the impact of changes in different variables on the token price (e.g., user acquisition or activity).

Our old strategy saw a lot of profit on paper which got wiped out as soon as the market hit a down curve. After implementing our new momentum strategy on October 19th, we started booking profits when our underlying assets prices reached our take profit levels. This approach gave us the advantage of realizing the gains in our books regardless of which direction the market moves after. An example is the 40% return we banked on Polygon while we would have been just around breakeven now had we not cashed in some profits. Another example would be the 31% in realized profits from GMX over a period of less than two months and Dopex’s return of 52% in a span of two weeks. Looking at the overall momentum strategy performance, we have achieved a return of 6% compared to the overall market decline of 12%, Bitcoin’s decline of 7.8% and Ethereum’s return of approximately 1% over the same period of two months.

Swing Trading

Trading in and out of tokens based on short-term market fluctuations. This allows us to take advantage and profit from the up and down movements in the market over a period of a few days to a few weeks. We have dedicated 10-20% of our portfolio towards this strategy and it has been yielding fruitful returns.

Options Strategies

Options trading gives us the ability to profit from a wide range of market conditions, whether the market is going up, down or sideways. Options are also very useful instruments for managing risks by hedging certain positions and for generating extra income through the sale of options on current holdings. Below are some of the options trading strategies which we have been deploying:

Covered Calls on Swing Positions

The covered call involves holding a long position and selling call options on that asset for a premium. We usually sell call options on our swing trade positions at a strike price near our take profit level. This allows us to generate income from the sale of the options premiums over the holding period before our take profit level is reached. If the underlying asset price rises to the strike price, we sell the asset at the higher price and keep the option premium as profit. If the underlying asset price stays the same or falls, we keep the asset and still collect the option premium as profit.

Protective Puts to Hedge Momentum Positions

Another options trading strategy we have been using to hedge against our long positions is the protective put. This strategy involves holding a long position in an underlying asset and buying put options on that asset. This protects us against potential losses if the underlying asset’s price falls. If the underlying asset’s price falls, we exercise the put options to sell the asset at the higher strike price and limit our losses. If the asset price stays the same or rises, we let the put options expire worthless and keep the asset in our portfolio or sell for a profit.

Volatility Trading & Delta Neutral Strategies

Volatility trading is a strategy that involves betting on the intensity of market movements regardless of which direction the market moves. One such strategy which has worked very well for us is the long straddle. The strategy entails buying a call and a put option with the same strike price, so that we would profit whether the market goes up or down as long the movement is beyond a certain range. We usually deploy this strategy when there has been a period of low volatility with an upcoming event or announcement that is expected to move markets. An example of this was when we entered into a long straddle within 7 mins after rumors about FTX’s demise first started circulating; we managed to profit from the market decline amid the extreme volatility that followed (as the put options we purchased as part of the straddle enabled us to sell the underlying asset at higher than market price plus premium paid to enter the straddle).

Crab Market Strategies

A crab market is when there is no significant move in the market in either direction, but rather is moving sideways. This means that the prices of crypto tokens are not trending upwards (bullish) or downwards (bearish), but rather are staying within a relatively narrow range. Swing trading is one strategy that could profit in such market conditions however there are other strategies using derivatives that we use to profit in such market conditions and these usually involve the use of derivatives in the exact opposite way of volatility trading. For example, when we are trading volatility, we mentioned that we enter into a long straddle position while taking the other side of the bet requires shorting a straddle, that is, selling a call and a put option to collect the premium as a profit and betting the asset price would not move beyond the strike level. Another strategy is shorting the crypto volatility index which is equivalent to the VIX in TradFi.

Yield Farming

Yield farming is a popular strategy in the world of decentralized finance (DeFi) that involves using liquidity pools and other DeFi protocols to generate a return on crypto holdings. Yield farming is synonymous to investing in real world financial assets such as stocks that pay dividends or lending money to borrowers to earn interest. In fact, not all yield in DeFi is sustainable; many protocols tend to offer yield that is based on inflationary rewards, which essentially means they are printing free money to cover the yield, causing the devaluation of the underlying asset. Those kinds of projects end up crashing as they do not capture real value and can be likened to Ponzi schemes. On the other hand, some protocols offer Real Yield, which is a return that is paid out in fundamental assets like ETH or USDC that were generated by the protocol in the form of revenue or interest. We have been dedicating an increasing portion of our portfolio towards different yield farming strategies to earn yields on all types of assets we hold. Some of the yield farming activities we have been engaging in include the following:

Providing Liquidity to Decentralized AMMs

Acting as market makers by providing liquidity to decentralized exchanges to earn a portion of the trading fees paid by users who are using the decentralized exchange. What this effectively means is that we help make sure there are always enough buyers and sellers for people to trade on the exchange. We earn a fee for doing this.

Providing Liquidity to Decentralized Derivatives Trading Platforms

We have also been providing liquidity to leveraged traders on derivatives trading platforms where we collect the losses experienced by those traders but make a loss if those traders profit. We don’t stop there, we go a step further by using the yield collected and deploying it in various strategies, which end up compounding our returns.

Staking

Another form of yield farming strategy we have been active in is staking tokens of protocols that pay out a share of the revenues generated by the protocol (similar to a dividend being paid to a stockholder) and restaking the yield on a periodic basis to compound returns.

Principal Protected Yield

There are many different types of strategies for farming stablecoins. The idea behind farming stablecoins is to be protected from downward market movements of volatile assets. However, yields on stablecoins are usually low so we try to amplify those returns by utilizing the yield to deploy high leverage trading strategies.

Market Neutral

Market neutral strategies are another way to eliminate market risk and focus on the underlying yield. This is achieved through “Neutralizing” a position such as staking an asset we own to earn a yield but then shorting the equivalent amount of the same asset, so that we are not exposed to the price movement of the asset and just earn the staking yield.

Portfolio Overview

Our portfolio currently consists of six tokens as part of our new momentum strategy; some examples of those tokens are GMX, Polygon and RocketPool. These are held for a period of 3-6 months but could be held for longer in case we believe there is still further room growth. In comparison, our old portfolio was diversified across 40+ tokens with a hold period of 3 years before pivoting to our new strategy. Although our old strategy allowed us to get exposure to a bigger number of exciting projects, it however limited the position size for each, which offset any meaningful returns on investment and was overly reliant on general market performance.

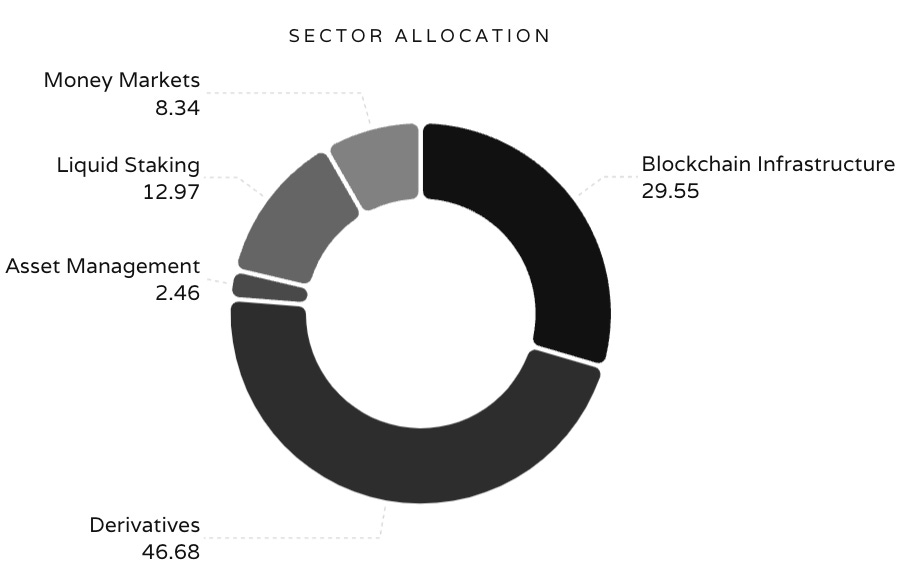

Currently around 50-70% of our portfolio is allocated to the above momentum picks, and another 20% is currently allocated to yield farming activities and option strategies. We typically hold cash reserves of around 15-35% depending on market conditions. As for the sectors, the largest allocation is currently in platforms that enable derivative trading (45%) followed by blockchain infrastructure (30%).

3GI Performance

As mentioned earlier, the market was unkind to risk assets this year due to macroeconomic factors which saw crypto and equity markets enter bearish territory. Crypto is perhaps the riskiest asset class as it is still new and misunderstood so it is only normal to have taken the biggest hit amongst the different asset categories. Bitcoin still shapes the lion’s share of the crypto market representing approximately 41% of the total crypto market cap, although this figure is down from 48.3% in June, but higher than the 39% it was in January. Bitcoin is considered the least risky crypto token given its first mover advantage, high awareness, deep liquidity and high volume. Ethereum comes in second with a share of 19.5%, up from 14.7% in June but still lower than 20% in January. These two assets which shape up around 60% of the total crypto market cap are down over 60% year to date.

The chart above starts on 24th March as that is when 3GI first started trading at an initial price of $1 per token and no data is available for earlier periods. From a general overview, we can conclude that all assets are highly correlated in terms of direction trajectory, however the magnitude of the movement differs. 3GI overperformed Bitcoin, Ethereum and Total Market Cap by a wide margin at the end of Q1. That was largely due to an investment in a new protocol called Stargate that shot up 20x in price in less than a week after it launched and 3GI was able to obtain an exclusive and attractive entry point, generating 4x returns in a span of hours. The 3GI price increased by 64% over that period from $1 to $1.64 while Bitcoin’s price increased by 3.6%, Ethereum by 5.6% and Total Crypto Market (TCAP) by 11.4%.

In the second quarter, Terra Luna and a bunch of big crypto funds collapsed which explains the steep downward movement in prices across all crypto assets in Q2. 3GI saw its token price decline from $1.64 at the end of Q1 to $0.58 at the end of Q2, representing a 64% quarter on quarter (QoQ) decline compared to Bitcoin’s -57.2%, Ethereum’s -67.5% and TCAP’s -55.9%. 3GI’s initial investment strategy focused on high risk high return tokens in order to outperform the market, therefore the market downturn’s impact was more severe on 3GI than other less-risky assets such as BTC and ETH. The market then kept fluctuating within a very narrow range in Q3 with brief rallies that slightly increased 3GI Price from $0.58 at the end of Q2 to $0.61 at the end Q3, representing a 5% QoQ increase compared to Bitcoin’s -1%, Ethereum’s 21.5% and TCAP’s -4%. On the other hand, the new strategy was designed to lower the risk without sacrificing the potential high returns, which was made possible using more complex and advanced financial instruments discussed earlier. The superior performance can be seen in Q4, where Bitcoin, Ethereum and the overall crypto market all took big hits amid the FTX fiasco, while 3GI’s downside was limited and thus outperformed all three benchmarks with an increase of 15% from the end of Q3 to date of this writing versus Bitcoin’s -8%, Ethereum’s -0.5% and TCAP’s -13% over the same period. 3GI is closing up on the year with -38.7% Year to Date (YTD) versus Bitcoin’s -59.5%, Ethereum’s -57.8% and TCAP’s -60.7%. We expect our new strategy to continue outperforming such benchmarks and to widen the gap further in 2023.

In addition to our directional investments, 3GI has generated 4% of the treasury’s value in yield farming activities. Currently we are farming 47% of the tokens we hold and expecting a yield of 6% annually. Those additional generated amounts are added up to the investments we hold and contribute to compounding returns.

The 3GI Token price at the time of writing is $0.62. 3GI Token holders’ individual returns differ depending on the price each has entered at. Some 3GI Token holders have entered at prices of less than $0.62 and are therefore in positive territory while others have entered at prices above $1 and are down more than the YTD figures stated above, as the 3GI Token launched at $1 but appreciated to an all time high of $1.64 before declining over a 3 month period towards its all time low of $0.49. We would like to assure all 3GI Token holders, no matter at which price they have entered, that we are more confident than ever in the long-term potential of our investment strategy’s ability to generate outsized returns and reach new all time highs within a timeframe of less than three years.

2023 Market Outlook

As we look ahead to the new year, there are a number of factors that will shape the market landscape in the coming months. As mentioned earlier, the market narrative in 2022 was dominated by inflation and the Fed’s rate hikes. We believe that the market is just starting to come to terms with higher rates but has now shifted its focus towards an increasing likelihood of entering a recession. The below are three primary factors that will have a considerable impact on macroeconomics.

Energy prices are expected to remain elevated amid increased demand from China following the loosening of its zero covid policy and Russia’s ongoing war on Ukraine. This is likely to keep inflation high, as energy is a key input in all economic activity and therefore, high energy prices tend to contribute to overall price increases in the economy. However, the bearish global economic outlook outlined below would ease pressure on demand for energy, which would then translate into lower prices.

The U.S. Federal Reserve will likely keep raising interest rates but at a slower rate and hold rates at heightened levels until we start seeing meaningful decreases in inflation levels. As discussed above, rate increases usually lead to a decline in borrowing and investing, resulting in an economic contraction. Many investors believe we could see a rate reversal with the Fed going back to lowering interest rates to counter a recession but this is unlikely unless in case of an extreme crash in the economy, as the Fed has made clear previously that it favors a mild recession over a prolonged period of stagflation.

We are also starting to see the higher interest rates’ impact on the real estate market. Rising mortgage rates make buying new homes or refinancing existing mortgages more expensive. Continuing down the path of rising rates will dampen demand for new homes and thus lower house prices. The biggest real estate funds and institutions are experiencing high redemption requests from their clients as treasury bonds now offer higher yields than real estate while having lower risk. These real estate funds will need to start liquidating their holdings to fulfill redemptions. This will have an adverse effect on the global financial markets and the health of the economy.

The above factors will likely add to the downward pressure on the financial markets that we already saw this year. This specifically applies to equities as companies will continue to report declines in profits and lower sales projections, which requires them to cut their costs by laying off employees and that kicks off a downward economic cycle which will most probably lead us into a global recession. We have already entered this phase but we believe the impact on financial markets could continue its downward trend before seeing a reversal.

We strongly believe that the cryptocurrency technology will continue to mature and advance, with increased adoption driven by an increased engagement from developers and users. While these factors are all fundamental for any growth in the market, we believe that the main catalyst for a crypto bull market in the short to medium term will depend on positive regulatory developments that will help drive institutional money into the space. We are optimistic that we are nearing regulatory clarity and could see major regulations introduced next year as pressure is building on financial regulatory bodies such as the SEC, FTC and the CFTC to speed up the regulation process given the rising fears that consumers aren’t being protected adequately given the spectacular collapse of FTX, Celsius, Terra Luna and others. Most institutions have been waiting on the sidelines to avoid any fallouts with financial watchdogs as crypto regulation is still not clear but this is expected to change once there is clarity on how crypto will be regulated. It has been reported that Venture Capital Funds are sitting on record levels of cash ($600B) while waiting for the economic outlook to improve and we expect that a big portion of those funds will flow into crypto related projects given their revolutionary impact.

Even though next year’s macroeconomic outlook is looking bearish, we anticipate crypto funding to pick up following the slowdown we saw in the second half of 2022. The collapse of the crypto market this year flushed bad actors and many highly leveraged traders out of the market. We believe this is good for the long-term health of the industry as it removes distraction and focuses on real advances. That said, we believe the crypto market is bottoming and will continue to move sideways throughout the first 3 to 6 months of 2023, after which we expect markets to start recovering.

HouseKeeping

Since the launch of 3GI, we had to make certain adjustments on the parameters we have set for our new investors:

Lockup Period The new lockup period is 3 years for any new investor, or for new rounds by existing investors

Minimum ticket The new minimum ticket to become a token holder has increased to $5,000

Thank you

In our opinion, the decline we saw this year was a bump on the road in the larger scheme of things. Despite the challenges, we remained focused on our long-term strategy and we continue to actively manage our portfolio. We carefully monitored market conditions and made adjustments to our positions as necessary; we also took advantage of opportunities to buy on the dip and increase our exposure to high-quality assets.

As a result of our efforts, we are pleased to report that our portfolio has outperformed the market in the last couple of months since we began executing on the new strategy and delivered favorable returns for our clients relative to market performance. The DCA (Dollar Cost Averaging) approach that some of our investors have taken by recently buying into an additional purchase of tokens at these discounted levels, has positively impacted the returns on their position.

Looking ahead, we remain confident in the long-term growth potential of the crypto market. While there may be short-term volatility, we believe that the underlying fundamental drivers of the market remain strong. We will continue to carefully manage our portfolio and pursue opportunities to generate returns for 3GI Token holders.

As we have communicated, we will be sending out monthly and annual newsletters. If there are certain topics you would like to see out of our reports, please contact us through any of the channels in the footer. If you found this letter interesting, please feel free to forward to your network.

Thank you for your continued trust and support, we look forward to a successful year ahead.

Anas Akkad, Managing & Founding Partner

Saeb Nahas, Founding Partner

Rami Baassiri, Founding Partner